Unveiling the Deceptive Web of Affinity Fraud: Protecting Communities from Financial Exploitation

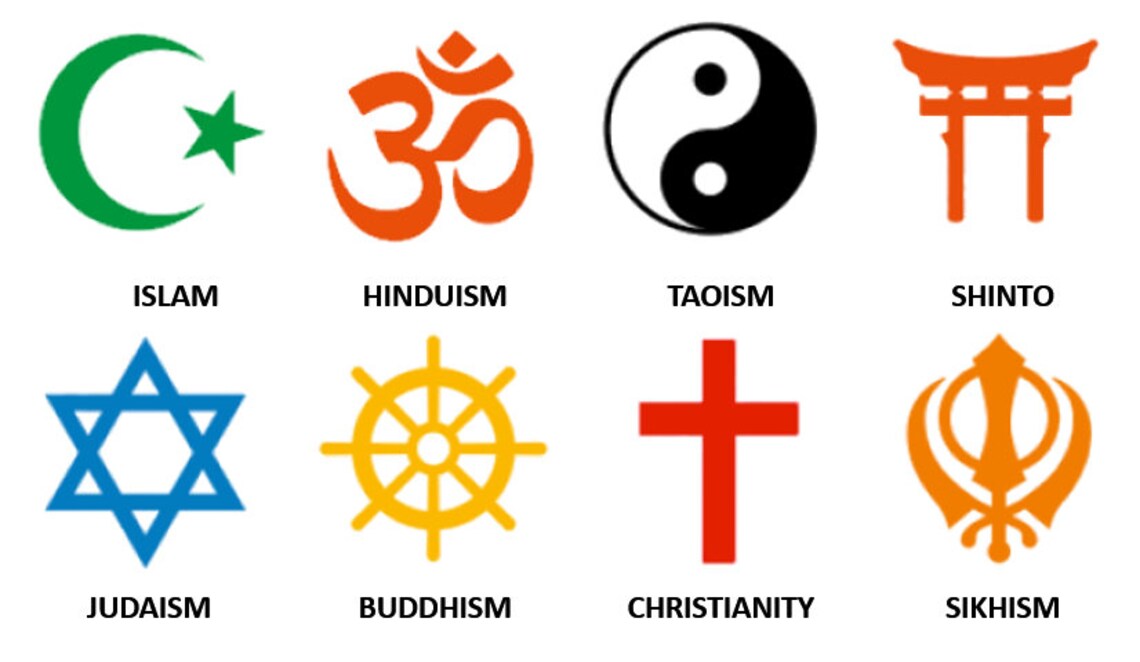

In the intricate world of finance, where trust is paramount, there exists a particularly insidious threat: affinity fraud. This form of deceit preys on the bonds of trust within close-knit communities, exploiting relationships to perpetrate financial scams. From religious congregations to ethnic groups, investment clubs to social organizations, affinity fraud has infiltrated various spheres, leaving a trail of financial ruin and shattered trust in its wake.

Affinity fraud operates on a simple yet effective premise: exploit the inherent trust and common identity within a group to gain credibility and access to potential victims. Perpetrators often belong to the same community or share similar characteristics with their targets, allowing them to establish a facade of legitimacy and credibility. They leverage this trust to lure unsuspecting victims into fraudulent investment schemes, promising lucrative returns or exclusive opportunities.

One of the most alarming aspects of affinity fraud is its ability to flourish under the guise of familiarity and shared identity. Victims are often deceived by the belief that because they share a common background or association with the perpetrator, their investments are secure. This false sense of security is precisely what makes affinity fraud so devastating, as victims may overlook warning signs or conduct proper due diligence. Additionally, affinity fraud perpetrators are using Social Media to wrap in their victims. They often hook up after finding them on on-line dating sites.

Religious communities, in particular, have become prime targets for affinity fraudsters. Exploiting the trust and faith of their fellow congregants, these fraudsters pose as devout members of the community, using religious rhetoric and affiliations to garner trust. They may frame their investment opportunities as blessings or divine opportunities, preying on the spiritual beliefs of their victims to justify their deceit. It is easier to hide your identity as a frudster if victims see you as deepy reliious as they feel that much devotion make makke the person too ethical to do evil.

Similarly, ethnic communities are often targeted due to the tight-knit nature of their relationships and shared cultural bonds. Fraudsters within these communities capitalize on cultural affinity, exploiting language barriers and cultural nuances to establish rapport and credibility. By positioning themselves as trusted members of the community, they manipulate social ties to gain access to potential victims, who may be more inclined to trust someone from within their own cultural background. We saw this when we look back to Bernie Madoff. Where did he find a lot of his victims – at the country club!

Investment clubs and social organizations, where members share common interests and goals, also provide fertile ground for affinity fraud. Fraudsters infiltrate these groups, presenting themselves as knowledgeable investors or financial experts. They may exploit the desire for exclusivity and insider access, promising members lucrative investment opportunities not available to the general public.

The consequences of falling victim to affinity fraud can be devastating, both financially and emotionally. Victims not only suffer significant financial losses but also experience feelings of betrayal and mistrust within their communities. The impact extends beyond individual victims, eroding the fabric of trust that binds communities together.

Preventing affinity fraud requires a multi-faceted approach that addresses both awareness and education within vulnerable communities. Empowering individuals with knowledge about common investment scams and red flags can help them recognize and avoid fraudulent schemes. Community leaders and organizations play a crucial role in disseminating information and fostering a culture of transparency and accountability.

Regulatory authorities also play a vital role in combating affinity fraud by enforcing laws and regulations designed to protect investors. Increased oversight and enforcement can deter fraudsters and hold them accountable for their actions. Additionally, collaboration between law enforcement agencies and community organizations can facilitate the identification and prosecution of affinity fraudsters.

In conclusion, affinity fraud represents a pervasive threat to communities, exploiting trust and shared identity to perpetrate financial scams. From religious congregations to ethnic groups, investment clubs to social organizations, no community is immune to the insidious tactics of fraudsters. Awareness, education, and collaboration are essential in combating affinity fraud and protecting vulnerable individuals from financial exploitation. By fostering a culture of vigilance and accountability, we can work towards building safer and more resilient communities resilient to financial fraud.

As fraud fighters we can help reduce the risk of affinity fraud by spreading awareness and talking to our associates about the scheme.

As a Newbie, I am permanently browsing online for articles that can be of assistance to me. Thank you

I抦 not sure the place you’re getting your info, but great topic. I must spend some time studying much more or understanding more. Thanks for wonderful information I used to be in search of this info for my mission.

We’re a group of volunteers and starting a new scheme in our community. Your website provided us with valuable info to work on. You have done an impressive job and our entire community will be grateful to you.

My brother suggested I might like this blog. He used to be entirely right. This submit actually made my day. You can not believe just how so much time I had spent for this info! Thank you!

Hey there! Do you use Twitter? I’d like to follow you if that would be ok. I’m definitely enjoying your blog and look forward to new updates.

Have you ever considered about adding a little bit more than just your articles? I mean, what you say is fundamental and all. However think of if you added some great images or videos to give your posts more, “pop”! Your content is excellent but with images and clips, this blog could certainly be one of the best in its field. Great blog!

Wonderful beat ! I would like to apprentice whilst you amend your web site, how could i subscribe for a weblog site? The account aided me a acceptable deal. I have been tiny bit acquainted of this your broadcast offered shiny transparent concept

I have been exploring for a bit for any high quality articles or blog posts on this sort of area . Exploring in Yahoo I at last stumbled upon this website. Reading this info So i am happy to convey that I’ve a very good uncanny feeling I discovered just what I needed. I most certainly will make certain to do not forget this website and give it a glance on a constant basis.

Wonderful beat ! I wish to apprentice while you amend your website, how could i subscribe for a blog site? The account helped me a acceptable deal. I had been tiny bit acquainted of this your broadcast offered bright clear idea

Hello!

Good cheer to all on this beautiful day!!!!!

Good luck 🙂

Greetings! Very helpful advice on this article! It is the little changes that make the biggest changes. Thanks a lot for sharing!

I would like to thnkx for the efforts you have put in writing this site. I am hoping the same high-grade web site post from you in the upcoming as well. Actually your creative writing skills has encouraged me to get my own web site now. Actually the blogging is spreading its wings quickly. Your write up is a great example of it.

I am now not certain where you are getting your information, but great topic. I must spend a while finding out much more or understanding more. Thank you for excellent information I used to be looking for this information for my mission.

There’s noticeably a bundle to learn about this. I assume you made certain good factors in features also.

obviously like your website but you have to check the spelling on quite a few of your posts. A number of them are rife with spelling problems and I find it very troublesome to tell the truth nevertheless I will certainly come back again.

Hello! I hope you’re having a great day. Good luck 🙂

I like what you guys are up also. Such clever work and reporting! Keep up the superb works guys I’ve incorporated you guys to my blogroll. I think it’ll improve the value of my website 🙂